Our society is a little crazy right now. The internet makes it worse. Things come across as if our whole society is SJW's (Social Justice Warriors) vs. neo-chauvinists; no gun restrictions at all vs. total banning of guns; unrestricted capitalism vs. full socialism; MAGA vs. laissez faire belief systems; hard core Christian evangelicals vs. atheists; etc., etc. When you get people talking, get them away from labels, there's still a lot of overlap in the directions Americans think this country should go. There need to be methods to support the consensus areas.

Monday, April 15, 2024

Monday, April 1, 2024

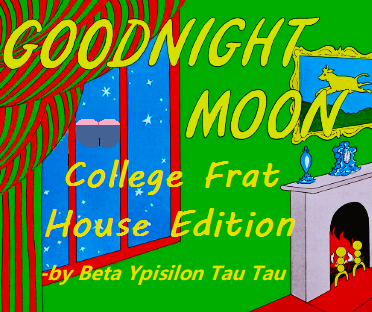

Failed Products

Sometimes products just don't catch on the way developers hope. Here are some product disappointments of recent years:

Oh, yes and Happy April Fools' Day! 😁 😜

Labels:

April Fools,

books,

children,

failure,

funny,

humor,

Marie Byars,

non sequiter,

parody

Friday, March 1, 2024

Sunny Days

Winter has been dragging on a long time in some places. Here are some of our terra cotta (and poured concrete) sun (and moon) faces to hopefully cheer you up.

This poured concrete one is new: one of my Christmas gifts to my husband. Some of the turquoise paint was on there, but I made the turquoise eye more noticeable. The moon part was all turquoise, no accents. We both thought it would look better with a terra cotta eye, "stars" and other accents, so I added those.

This terra cotta one was our out-front stand-by for years. It was also a past Christmas gift to my husband. I added the turquoise details for effect. (Our current house, Mediterranean style, has a terra cotta house number sign. I painted the numbers turquoise, too.) The cracks are just the aging of untreated terra cotta, which is like those pots for plants. The super glue will prevent further cracking, but he's "lost points", too. He's going on the back wall.

.jpg) |

| Rodney Dangerfield dopplegänger? |

This smaller terra cotta face has mostly been an inside decoration. He's too small to see well outside. Turquoise accents also added by me.

This sun/moon was also a gift to my husband. He painted this one quite brightly years ago. It is also an indoors decoration.

Labels:

aging,

Christmas,

contentment,

friendship,

happiness,

humanity,

Love,

Marie Byars,

moderation,

nature,

property

Wednesday, February 7, 2024

Truman's Swans

In the early months of 2024, FX generated a lot of buzz about its Season 2 series of The Feud. The season focused on Truman Capote's "swans."

But decades before the FX program, even before the real Truman Capote was famous, there were the original Truman's swans. Harry Truman loved his swans. Biographies will say that Harry had no middle name, just the letter "S" to honor his grandfathers. In reality, the "S" stood for "Swans", his mother's great love. In 1948, he even threw a Black & White Valentine's Day Ball for them in the White House.

The swans were a jealous bevy. They turned on each other and became aggressive.

Truman got his revenge. He sent them to the Kansas City (Missouri) Zoo. Their descendants are still annoyed by loud humans and their offspring today.

Labels:

April Fools,

funny,

happiness,

history,

humanity,

humor,

Marie Byars,

non sequiter,

parody,

patriotism,

politics,

success,

Veterans

Thursday, February 1, 2024

February 14th Hoopla

Why is February 14th, (Saint) Valentine's Day, such a cash cow 💰💸🐄🐮for Hallmark, florists & chocolatiers? 🎴💟🍫🎕

While a lot of stories turn out to be urban myths, Geoffry Chaucer's poem "The Parlement of Foules" ["The Parliament of Fowls"], written around 1375, seems to be a real reason why.

From Chaucer, in Middle English:

For this was on Seint Valenteyns day

When every foul cometh ther to chese his make...

As they were wont alwey fro yeer to year,

Seint Valenteyns day to stonden there...

Seint Valentyn, that art ful hy on-lofte

Thus syngen smale foules for thy sake...

-OR-

For this was on Saint Valentine's Day,

When every fowl comes there to choose his mate...

As they regularly do from year to year

On Saint Valentine's Day staying firmly there...

Saint Valentine, that is fully lifted up (upon us)

Thus sing small fowls for your sake...

What? This holiday morphed from something quasi-Christian to a poem about bird love to a serious cash layout to show you really care?

There were possibly up to three Valentines who lived in the third century A.D., when Christians were being persecuted by Romans. Possibly one or more died on February 14th.

The stories about Valentine speak of love, but not romantic love. It is a "fraternal" love for brother and sister Christians, played out by extreme sacrifice.

However, prior to that, the Romans had looked at February as a "month for lovers", so that may have influenced why Chaucer set his meeting of the birds on St. Valentine's Day. Ordinarily, that seems a bit early for mating season in England.

So, if you're done with the V-D routine, try something different. Offer to read your loved one Chaucer's poem in Middle English. That ought to kill any over-the-top romantic expressions (unless you're both majoring in older English literature). 😅

If you're Christian, you could always view the theatrically released movie Paul, the Apostle of Christ as a family. That movie shows the type of love Valentine was said to exhibit.

Happy Valentine's Day!

Labels:

contentment,

disappointment,

happiness,

humanity,

irony,

Jesus Christ,

literature,

Love,

nature,

religion,

success,

Valentines Day

Saturday, January 13, 2024

Friday, January 12, 2024

Spare No Expense

The one-year anniversary of Spare in January 2024 has been an inspiration!

Many hoped that Harry and Meghan would "platform" a little less. The pontificating was wearing to many of us. They don't really seem like the shining examples they would like to portray themselves as.

Whatever they do, they will still seek income. As Meghan develops her line, perhaps Harry could develop these Spare-related products, which would practically sell themselves:

Obvious but useful! In an era where most "spares" are the annoyingly small donut tires (tyres), Harry could spearhead a movement back to full-sized spares!

Who doesn't need to keep a few spares of these around? Even though we're past the COVID shortages, you don't want to be caught without extras of toilet paper, or loo rolls, as Harry's native UK refers to them.

Most of us keep some spare towels around.

Or if you want to play up the "misfit" aspect, as Spare does, maybe this collection is for you:

For more ideas on possible Harry merch, check out these links:

Labels:

April Fools,

disappointment,

economy,

failure,

funny,

humanity,

humor,

irony,

Marie Byars,

non sequiter,

parody,

Perseverance,

royal family,

success

Subscribe to:

Posts (Atom)

.jpg)

.jpg)

.jpg)

.jpg)

.jpg)

.jpg)